Business Climate

Low taxes and warm weather. Must be Florida.Pro-Business Climate

Florida’s huge market and pro-business climate help companies reach growth and expansion goals with ease.

Florida consistently ranks among the best states for business, thanks to its pro-business state tax policies, competitive cost of doing business and streamlined regulatory environment. Government and economic development leaders work together to ensure that the state’s business climate remains favorable to companies of all sizes, including some of the nation’s leading corporations.

Beyond that, Florida offers a cost-efficient alternative to high-tech states with more affordable land, labor and capital than its competitors. The state’s regulatory agencies and local governments provide quicker, less costly and more predictable permitting processes for significant economic development projects without reducing environmental standards. Florida’s zero percent personal income tax also makes it easier for you to build the business of your dreams. More money in your pocket today means more flexibility to spend on your business, your family and your future.

Quick Links

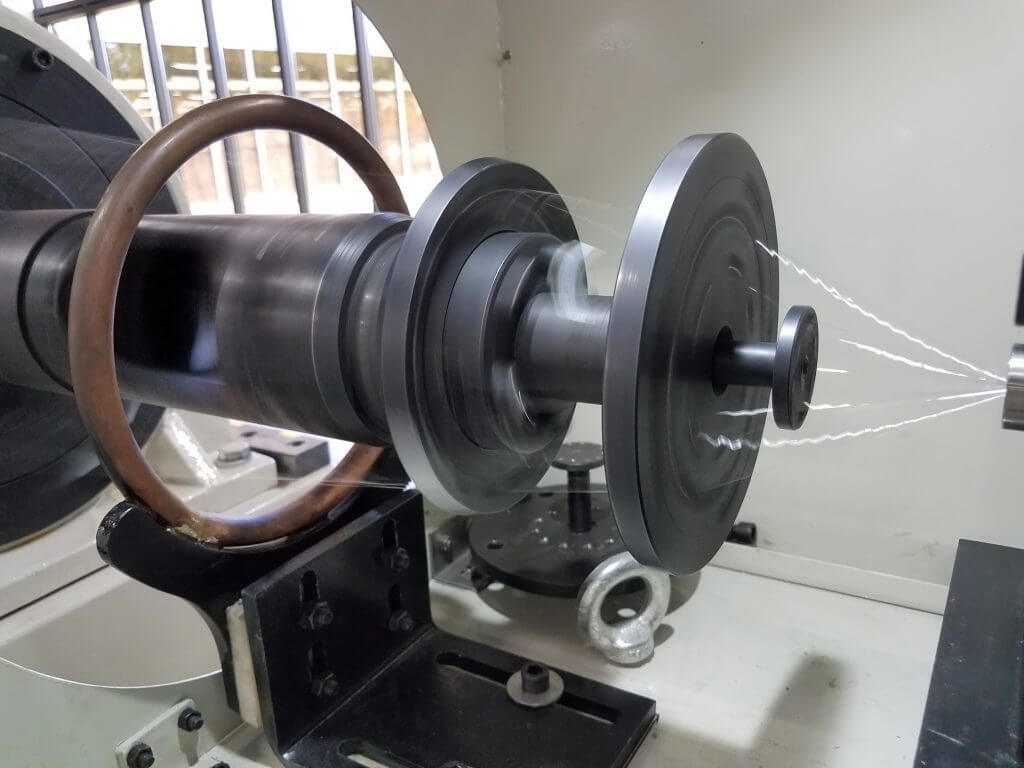

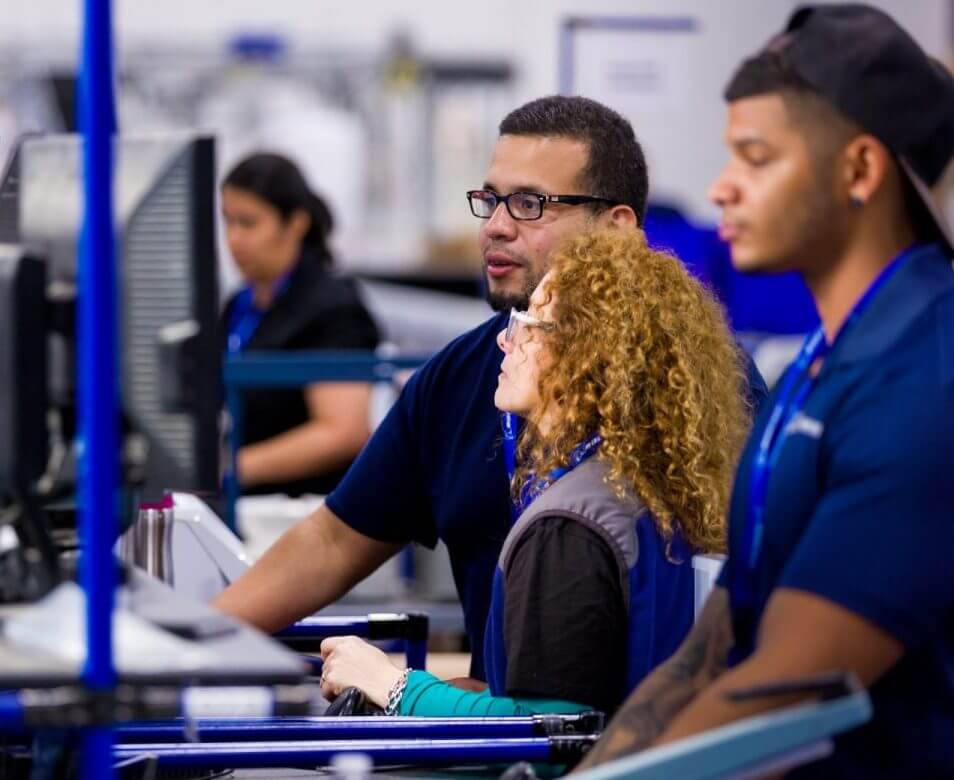

Workforce and Talent Development

With the third largest workforce in the U.S., Florida provides the workers needed to allow your business to succeed. Graduates from the nation’s best high education system provide the skilled talent to help achieve your goals.

Florida’s diverse workforce comprises over 11 million people and is supported by a strong education system that continuously prepares the next generation’s talent.

- #1 U.S. State for higher education 5 years in a row, (U.S. News and World Report)

- #1 U.S. State for attracting and developing talent, (Lightcast Talent Attraction Scorecard)

- Over 100,000 science and engineering degrees are awarded annually, (Lightcast, National Center for Education Statistics)

For more information on Florida’s workforce, please visit the Florida Insight webpage.

We work closely with our business community to provide workforce development and educational programs tailored to our industry needs.

Policy

Ranked as the top state in the U.S. in terms of tax policy, Florida is a model for how states can foster advantageous fiscal environments for companies. When businesses succeed, people succeed, and Florida focuses on bettering the lives of everyone within its state by creating a favorable tax climate.

Florida is the #1 U.S. State for new business formation.

(U.S. Census Bureau)

The Sunshine State has one of the best business tax climates in the U.S. according to The Tax Foundation and here are some of the reasons:

- No corporate income tax on limited partnerships

- No corporate income tax on subchapter corporations

- No corporate franchise tax on capital stock

- No State-level property tax assessed

- No property tax on business inventories

- No property tax on goods-in-transit for up to 180 days

- No sales and use tax on goods manufactured or produced in Florida for export outside the state

- No sales tax on purchases of raw materials incorporated in a final product for resale, including non-reusable containers or packaging

- No sales/use tax on co-generation of electricity

0% State personal income tax is guaranteed by constitutional provision.

Taxes and Business Incentives

Florida can help you succeed because, quite simply, Florida succeeds. As one of the U.S. top economies, it has already proven that the Sunshine State knows how to stimulate economic development, and it’s primed to welcome your business into the mix.

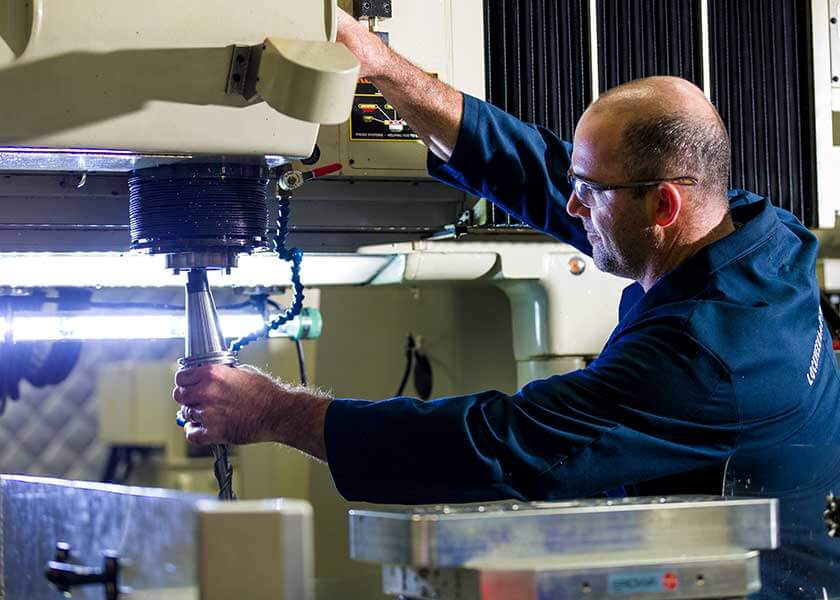

Florida offers incentives for all types of businesses, from corporate headquarters to manufacturing plants and service firms.

Attractive capital investment credits encourage capital-invested industries to set up in Florida, while training incentives provide the possibility to expand the knowledge and skills of future and current employees. Florida encourages growth throughout the state by offering increased incentive awards and lower wage qualification thresholds in its rural counties. The state also offers increased incentive awards and lower wage qualification thresholds for businesses locating in many urban core/inner city areas that are experiencing conditions affecting the economic viability of the community and hampering the self-sufficiency of the residents through urban incentives. Florida’s tax advantages are front and center when creating incentives to move business to Florida.

TAX CREDITS, FUNDING AND GRANTS:

- Capital Investment Tax Credit (CITC)

- Research and Development Tax Credit

- Quick Response Training (QRT)

- Incumbent Worker Training (IWT)

- Brownfield Redevelopment Bonus

- High Impact Performance Incentive Grant (HIPI)

SALES TAX EXEMPTIONS:

- R&D Equipment (Predominant Use)

- Semiconductor, Defense, and Space Technology Production Equipment

- Manufacturing Machinery and Equipment and Subsequent Labor, Parts, and Materials Used to Repair Equipment

- Electricity Used in The Manufacturing Process

- Clean Energy

- Aircraft Expenditures

- Spacecraft Expenditures

OTHER:

- Expedited permitting assistance for qualified projects.

- Opportunity Zones

- Urban Incentives

Visit the FloridaCommerce webpage to learn more about business resources.

Incentive Wage Requirements As of 1/1/2023

- Average Wage Requirements – County (coming soon)

- Average Wage Requirements – MSA (coming soon)